What can Bitcoin tell us about the future of retail payments with digital currencies? Insights from merchant use and perceptions.

[UPDATE] Since publication of The Bitcoin Sentiment Tracker - Merchant Study, the Libra Association underwent a rebranding to the Diem Association, therefore resulting in the rebranding of the currency from Libra to Diem, effective December 2020.

DISCLAIMER: Articles are written to reflect the interests and views of the author(s), and are not intended as an official Payments Canada statement or position.

Summary1

The Bitcoin Sentiment Tracker - Merchant Study, prepared for Payments Canada by CorbinPartners, examines the attitudes of merchants towards the use and acceptance of Bitcoin for retail payments. It complements a study published last year by Payments Canada on consumer attitudes towards Bitcoin. Merchants that accept Bitcoin, previously accepted Bitcoin or that do not accept Bitcoin, as well as cryptocurrency exchange operators and other industry players were included in the study. The results indicate weak acceptance of Bitcoin as a payment method by merchants - driven largely by lack of demand. However, this is balanced by a positive view towards Bitcoin’s persistence and growth, both as a currency and as an asset, facilitated by an evolving regulatory framework.

This piece presents a brief overview of research interest in Bitcoin in Canada, discusses obstacles to Bitcoin acceptance for retail payments, and considers implications of the study findings for Bitcoin use as well as other digital currencies, including Libra and Central Bank Digital Currencies (CBDCs).

Bitcoin was originally envisioned as a currency for eventual use in everyday transactions. A form of money that encompassed the defining characteristics of a store of value, medium of exchange and unit of account. Created as a reaction to the fallout of the 2008 crisis and accompanying cynicism regarding currency manipulation by the central banks2, it offered the additional advantage of being issued and processed in a decentralized, algorithmic way, free from “the inherent weaknesses of the trust based model”.

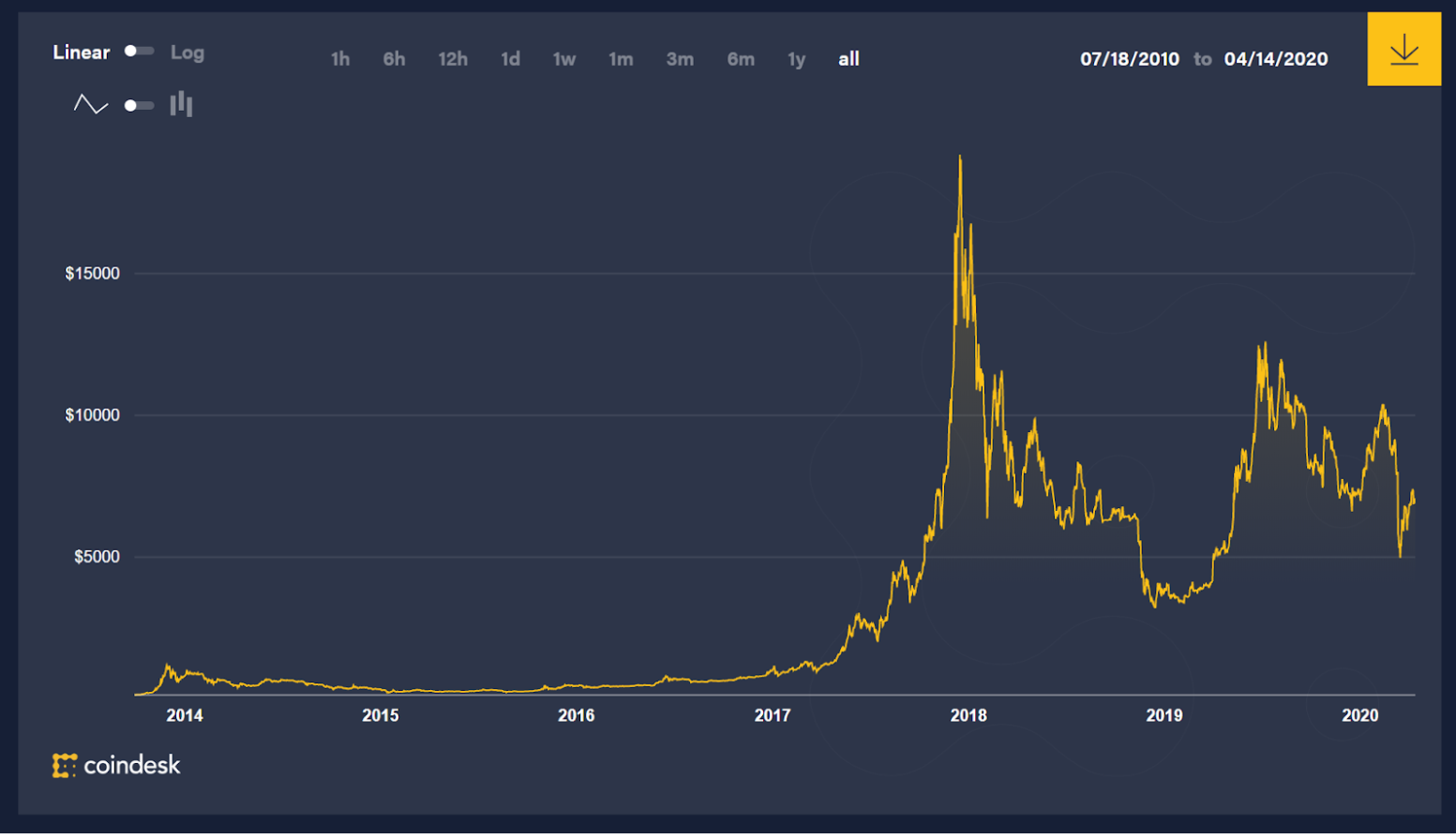

However, Bitcoin’s constrained user base - and associated illiquid market - have made it a volatile store of value and a limited candidate for medium of exchange in most settings. From the first coin issuance in 2009 until its peak value in 2017, Bitcoin was driven by speculation to near infinite price growth, rising from a half cent per Bitcoin in the first documented transaction to just shy of $20K US by December 2017 (see Figure 1). Since that time it has continued to exhibit much more volatility than established fiat currency, over 40 times greater than that of the Canadian dollar against USD in 2019, as an example.3

Figure 1. Bitcoin vs US dollar. Source: Coindesk

Bitcoin research in Canada

In 2016 and 2017, with Bitcoin and all things crypto dominating finance, payment system operators and monetary authorities around the world warily eyed Bitcoin’s potential for retail payments. It seemed like a distinct probability with big names such as Dell Computing and Microsoft, as well as an estimated 100,000 merchants worldwide accepting payment in Bitcoin. It was in this context that a flurry of legal, policy and research interest began in Canada.

The Bank of Canada’s Bitcoin Omnibus Survey (BTCOS), which tracks ownership, knowledge and use of the crypto-asset was inaugurated in 2017 and published its third wave in 2019. The survey has charted significant increases in awareness and ownership, but also significant abandonment of the crypto-asset. Investment remains the key - although declining - reason for ownership, while use for payments has stabilized as a second-tier reason, after a sharp decline between 2016-2017. These findings were consistent with a study carried out by the Ontario Securities Commission in 2018. The study found that although speculation was the key driver for ownership, one-quarter of respondents intended to use crypto-assets for payments.

Demographics play a significant role in adoption of all payment types and Bitcoin is no exception. According to the BTCOS report, users increasingly are more likely to be young, university-educated and male, although ownership was also correlated with low financial literacy.

The Bitcoin Sentiment Tracker

The Bank of Canada’s, “main interest in monitoring Bitcoin adoption is to understand how its usage by Canadians could affect the financial system”, particularly its effect on the use of cash and as a potential “vulnerability” to financial stability. Payments Canada has similar concerns with regards to payments systems.

The Bitcoin Sentiment Tracker, prepared for Payments Canada by CorbinPartners, was conceived as a baseline to gauge consumer and merchant views on use and acceptance of Bitcoin and provide insight into the underlying motivations and perceptions that drive adoption. Bitcoin was selected because it was (and still is) the most prevalent form of cryptocurrency by market capitalization and exchange volume.

The first wave of the Bitcoin Sentiment Tracker, looking at consumer attitudes, was released in June 2019, based on data collected between July and October 2018. It showed that while most Canadians were aware of Bitcoin, few owned it; of those, curiosity was the driving factor in acquiring it. And while speculation was a key use case for the cryptocurrency, not many had used it to make retail purchases. A major reason cited was lack of acceptance by merchants. Previous work by Corbin Partners had suggested a “chicken and egg” phenomenon where little consumer demand existed for Bitcoin as a payment option because acceptance was sparse and vice versa.

The current study explores the merchant side of Bitcoin retail payments experience. The results indicate weak acceptance of Bitcoin as a payment method by retail merchants, unsurprisingly driven largely by lack of consumer demand. However, this is balanced by a positive view towards Bitcoin’s persistence and growth, both as a currency and as an asset, facilitated by an evolving regulatory framework.

Obstacles to Bitcoin use for retail payments

The study explores a number of factors driving weak acceptance of Bitcoin for retail payments.

First, the aforementioned volatility acts as a double-deterrent. While consumers may not want to pay with a currency that is rapidly escalating in value (think of the person who spent 10,000 Bitcoins on two pizzas in 2010 - the equivalent of approximately US$200M by the end of 2017), merchants don’t want to accept a rapidly declining currency for the same reason. The resulting illiquidity, compounded by concentrated ownership, can lead to dramatic price swings.

Acquiring, using and storing Bitcoin can also be daunting (especially to new users) and risky (the study identifies the $260 million Quadriga debacle as case in point). For this reason, many merchants and consumers prefer the legal protections and recourse associated with fiat currency use. Merchants surveyed in this study indicated they would be much more likely to accept Bitcoin if it was supported by legal protections and widespread use by mainstream financial players.

Beyond issues of loss and recourse, the policy and regulatory playing field for cryptocurrencies and the underlying blockchain technology is still a work-in-progress in Canada. Bitcoin and other cryptocurrencies are now primarily designated as assets, falling under the purview of provincial securities laws in Canada. Recently, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act has also been amended to ensure money services businesses (MSBs), including those that deal in virtual currencies adhere to reporting practices. However, the regulatory story is still unfolding as authorities seek to define rules for issuing crypto coins and tokens, tax treatment of revenues, and regulation of crypto exchanges and platforms as entities. The study suggests that having these regulatory measures in place could positively influence merchant acceptance of Bitcoin.

Bitcoin performance also is found lacking for certain on-the-spot transactions in the retail merchant environment. Bitcoin payments require an unpredictable amount of time for confirmation, ranging from 30 minutes to several hours. Paying incentives to miners speeds things up, but can amount to a significant cost that undermines the worth of the transaction itself, even when compared with wire fees or credit card merchant discount rates. Increasing Bitcoin volume compounds the queuing problem. And solutions in a decentralized space are difficult to implement and have existential side effects, such as the creation of a new cryptocurrency (e.g. Bitcoin Cash) through a “fork”.

Perhaps the main impediment to Bitcoin retail purchases isn’t endemic to the cryptocurrency itself. For most use cases (i.e. reasons for paying), consumers simply have better options. For face-to-face transactions, cash is easy and anonymous. Card payments are lightning quick (from the consumer perspective) and convenient, and may offer motivating incentives. Even arduous cheque-writing has been mostly displaced for consumers by convenient bank portal bill payments and automatic withdrawals. Business payments are still cheque-heavy, driven by a need for remittance data that Bitcoin is unlikely to address.

Digital currency alternatives

Even Bitcoin’s utility as a digital form of cash has competition. Libra, the Facebook-led currency-basket-backed digital currency evoked a strong response from regulators when it was first announced in mid-2019, primarily due to its potential to undermine monetary sovereignty if widely adopted. Facing gale-force headwinds from central banks and regulators, it has since back-pedalled towards multiple, individual-currency-based stablecoins. Many commentators suggest that Libra is likely to be relegated to the role of a multi-currency digital wallet, akin to Paypal - although with massive potential based on its reach and marketing acumen.

Central banks - issuers of fiat currency - are reacting to the emergence of Libra and Bitcoin with their own digital currencies. Central Bank Digital Currencies (CBDCs) are fiat notes and coins in digital form. Instead of carrying money in a physical wallet, CBDC resides in a digital wallet administered by financial institutions or the central bank itself. Unlike Bitcoin, which solves the problems of ownership and double-spending through a public, permissionless blockchain, CBDC would be tracked in a digital (potentially privately-distributed) ledger by trusted entities. This is anathema to the proponents of Bitcoin, but perhaps an attractive alternative for consumers who are more comfortable using their own national currency.

In Canada, CBDC is far from in-market. In a recent position paper, the Bank of Canada indicated it is, “building, as a contingency, the capability to issue a cash-like central bank digital currency (CBDC) to the public, should the need ever arise.” The most prominent factors driving this need would be a precipitous decline in cash use and its associated ubiquity, or if, “one or more alternative digital currencies—likely issued by private sector entities—were to become widely used as an alternative to the Canadian dollar as a method of payment, store of value and unit of account.”, as well as other policy issues such as, “depositors’ need for control”.

Recent research by Payments Canada, conducted during the Covid-19 crisis, has shown a sharp drop in cash use. This is partly because all consumption is down, especially at the physical POS, but also because cash is suddenly a potentially unhealthy medium of payment. Accordingly, plans for a Canadian CBDC may be moved from contingency to the fast track. On cue, the Bank of Canada has recently released a rash of thought-pieces on privacy, universal access, security and other considerations associated with CBDC and digital money.

The Bank of Canada pieces illustrate the thorny legal, economic and monetary issues associated with CBDC issuance, such as the role for commercial banks in storing, lending and creating money, and the trade-off between privacy and public safety (e.g. anti-money laundering), not to mention whether consumers would use it. Around the world, the story is much the same; sobre exploration by central banks with China beginning to trial the e-RMB and near-cashless Sweden beginning to test the e-krona.

Wider insights from the study

This study focuses on Bitcoin as the dominant cryptocurrency, but what of these alternatives? Merchant respondents did indicate their views on cryptocurrencies more broadly on many of the items covered in the survey. The focus groups and executive one-on-one interviews also allowed open-ended discussions where Bitcoin alternatives could (and did) surface. The fact of the matter is that, although it is rarely used for retail payments, Bitcoin is still by far the top-of-mind option when merchants consider the space, with no close competitors. Other cryptocurrencies and stablecoins did not emerge as serious contenders. CBDC is still an unrealized contingency and awareness is accordingly quite low, particularly when compared to an in-market reality like Bitcoin. In short, for most merchants, digital currency and Bitcoin are more or less synonymous, even though they rarely have the opportunity, or desire, to accept it. That may change. If so, this study will provide a useful baseline to compare and contrast digital contenders as they enter the market.

Regardless of the future for digital currencies, it is almost certain that a challenger will emerge to compete with cash, offer immediate and cheap remote payments anywhere in the world, be ripe for integration with end users’ digital lives and apps, and yes, provide an anonymous channel for illicit fund transfers. The merchant views in this study suggest that Bitcoin is here to stay and will be complemented by other digital offerings and new use cases, such as its use for collateral in lending. The veracity of this view may be supported by Bitcoin’s surge in response to the initial Libra announcement. However, regardless of which digital currency eventually reigns supreme, the results of the study will inform other digital currencies as they emerge, even if Bitcoin’s use in retail payments is currently near its nadir.

Download The Bitcoin Sentiment Tracker | Consumer Edition

Author

Jeffrey Stewart

As a Business Analyst at Payments Canada, Jeff is responsible for analyzing and developing educational material for the Canadian payments ecosystem and conducting research in support of payments modernization initiatives. His research interests include data in payments, closed-loop ecosystems, monetary policy and decentralized currency. Prior to joining Payments Canada, Jeff worked in the private and public sectors as a policy analyst, researcher and programmer, and as an independent business owner. Jeff holds Master's Degrees in Cognitive Science and Public Administration from Queen’s University.

1 The views presented in this paper are those of the authors and do not necessarily reflect the views of Payments Canada.

2 For example, the genesis block contained the text: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

3 Measured by standard deviation as a percent of mean value. Source: Yahoo! Finance (CDN/USD); Cryptocompare.com (BTC/USD)