Payments challenges and opportunities

Consumer payment options and frictionless transactions are critical to drive business advantage in an era of digital payments — Canadians seek more payment choices, including to pay bills and taxes

The pace of innovation within Canada’s payments ecosystem continues to accelerate. Further fuelled by the pandemic, Canadians seek — and expect to be offered — increasingly diverse digital payment options. In turn, the payments ecosystem continues to focus on delivering faster, more convenient, and secure payment experiences across a multitude of platforms — from contactless and mobile payments, e-commerce, and electronic person to person (P2P) transfers.

While payments innovation continues to deliver significant benefits for businesses and consumers, new research explores the current state of payment pain points and frustrations from the eyes of consumers in an era of increased digitalization.

In brief

Payment constraints and limits on transfer amounts are the most prevalent payment pain points

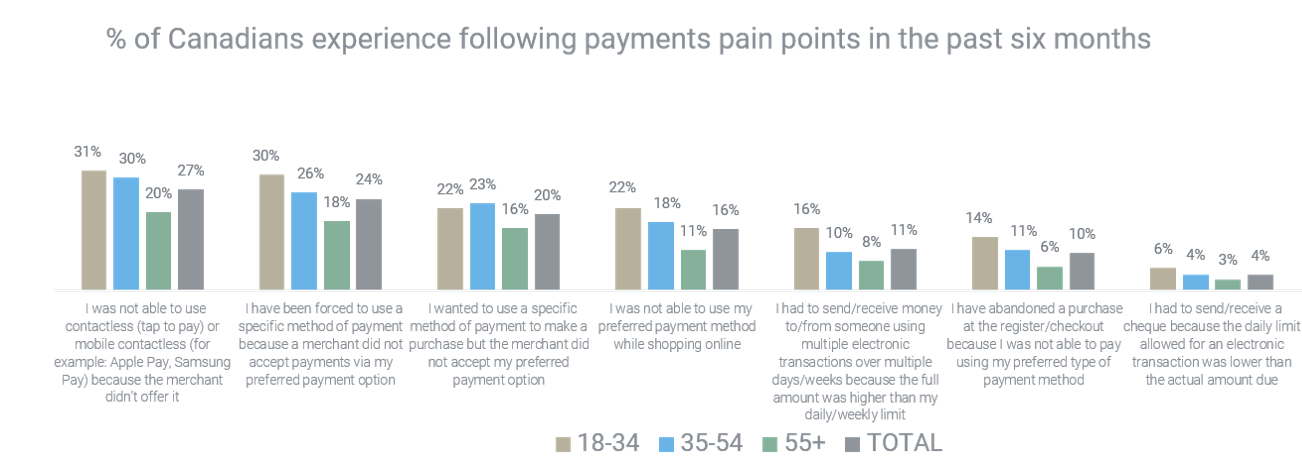

Almost three in five Canadians (57 per cent) report experiencing some form of payment friction in the past six months. These encounters primarily relate to either payment choice constraints (when consumers are not able to use their preferred payment method or are forced to use a payment method not of their choosing), or limits on transfer amounts1.

While security and lack of merchant payment choices create the biggest frustrations overall — frustrations differ by age demographic

Beyond fees, overall the biggest payment frustrations Canadians report relate to security with executing payments (by 29 per cent of Canadians), as well as the lack of merchant payment options (with 29 per cent who report being frustrated by stores not offering contactless payments, and 23 per cent who are frustrated when not all payment methods are accepted). However, payment frustrations differ by age demographic with noticeable differences between younger and older cohorts.

- Younger Canadians (18 to 34) are more concerned about being able to make and receive payments faster (i.e., fewer steps to complete, shorter wait time to process online payments, shorter wait time to send/receive electronic transfers), as well as having more payment method choices at merchants, and limits on transfer amounts.

- Not being able to use contactless payments (card or mobile tap-to-pay) for store purchases is a key payment frustration for young Canadians (31 per cent), which is to be expected given that they are more likely to tap their cards and use mobile wallets.

- Older Canadians (55+) are more concerned about improving payment security (33 per cent) when making a payment or executing a transfer, and safety convenience (24 per cent), i.e., not having to remember passwords/PIN when making a payment or transferring funds.

Nearly half of Canadians experience frustration when paying their bills

Nearly one in two Canadians (48 per cent) experience some form of frustration when paying their bills, with the younger cohort being significantly more likely to report frustrations (65 per cent).

Beyond not having enough money, the primary pain points experienced by young Canadians (18 to 34) when paying their bills are remembering the due date, the slowness for transactions to appear on the account, having to pay extra fees, not being able to pay by credit card, and not having more bill payment choices.

Sending and receiving money internationally presents the biggest opportunity for improvement

Canadians struggle more with sending or receiving money internationally than any other payment use. Only around one in five Canadians (22 per cent) report finding it easy to send or receive money internationally.

- Young Canadians (18 to 34) are most likely to find it difficult sending/receiving money internationally (19 per cent). They also frequently send money internationally (46 per cent), which is more than any other age group.

- Besides fees, concerns about security and overall transparency (not knowing the currency exchange rate before the transaction is settled and cleared); and slowness for transactions to appear on the account represent the biggest challenges reported by young Canadians when sending money internationally.

- Over one in three new Canadians (38 per cent) frequently send money abroad, with a key concern being the slowness for transactions to appear on the payee account (13 per cent).

Frustrations around making person to person payments (P2P) differ by age

In general, Canadians who make frequent P2P payments look for payment methods that are convenient to use, fast, secure and allow them to track their payments. There are noticeable differences between young and older Canadians concerning the payment types they choose, and the nature of the payment frustrations and challenges they face when making P2P payments.

- Interac e-Transfers is the main method of choice for making P2P payments among young Canadians (70 per cent), while older Canadians (55+) use a wider variety of methods – Interac e-Transfers (57 per cent), bank transfers (21 per cent), cheque (9 per cent), and cash (8 per cent).

- Young Canadians are mostly concerned about reducing or eliminating fees, reducing wait time for the payment to go through, and making the process easier for initiating a P2P transfer.

- Older Canadians (55+) are mostly concerned about improving security with executing P2P payments.

Enabling Canadians to directly pay their taxes by credit card will help reduce payment friction

Canadians prefer to electronically pay government taxes, either through their online banking account using bill payment, via a pre-authorized debit, or credit card.

Nearly one in five Canadians prefer to pay their taxes using a credit card (17 per cent) but are not able to directly make payments to the Canada Revenue Agency using this payment method. Instead, they have to go through a third-party payment service provider and pay extra fees in order to pay their taxes by credit card. This is a potential source of frustration for Canadians preferring to pay this way, creating unwanted complexity and expense for consumers.

In conclusion

The payments ecosystem continues to constantly innovate to meet shifting consumer needs and expectations, with fewer steps to complete transactions, shorter wait times to process online payments, user ease of enhanced security features, and shorter wait times to send and receive electronic transfer. But at the core of consumers’ payment needs — Canadians want choice.

Consumers expect merchants and businesses to provide payment options to meet their preferences, whether at the point of sale, for online purchases, or to pay their bills and taxes. Speed, security, convenience, traceability and having payment options are all key factors that impact Canadians’ payments experience — and that can make the difference between a frictionless experience and creating frustration.

With more and more Canadian consumers making purchasing decisions based on their payment preferences, this points to a significant opportunity for businesses and organizations to continue to expand payment options to drive efficiencies and enhance their consumer experience.

Modernization of Canada’s payment systems will support these payment preferences, today and in the future. Two specific examples include the introduction of Canada’s real-time payment system, which will deliver innovative and convenient payment options that provide more choice to businesses and consumers. Payments Canada’s Government Cheque Reduction Initiative will also support convenience for consumers and businesses, in the form of faster, more secure access to funds, increased payments processing efficiency and reduced operational costs.

Contact us for a complete version of the research report.

1 Since this research was conducted, Interac increased their transfer limit to $25,000

About the research

The findings in this report are sourced from the Leger/Payments Canada 2021 Consumer Payments Behaviour Tracker Survey (Wave 1). Note: some information contained in this report is sourced from additional waves of the survey tracker and is indicated where applicable.

In total, 1,504 Canadians were interviewed online, between March 4–23, 2021 using Leger’s online panel, which has approximately 400,000 members nationally and has a retention rate of 90%. The sample is nationally representative of the Canadian adult population. The margin of error for this study was +/-2.5%, 19 times out of 20. All significant differences are reported at the 99% level.