Canadians rapidly adopting new payments channels

Electronic payments account for 73 per cent of all transaction volume versus cash at 21 per cent, reports Payments Canada.

OTTAWA, December 5, 2019 - New technology and payments innovation are transforming the way Canadian consumers and businesses make payments, according to data from Payments Canada’s annual Canadian Payment Methods and Trends report.

In pursuit of more convenient, faster and secure payment experiences, Canadians are rapidly adopting newer digital channels, such as contactless (tapping card or mobile), e-commerce, mobile and online transfers, in favour of more traditional ‘paper and coin’ payments.

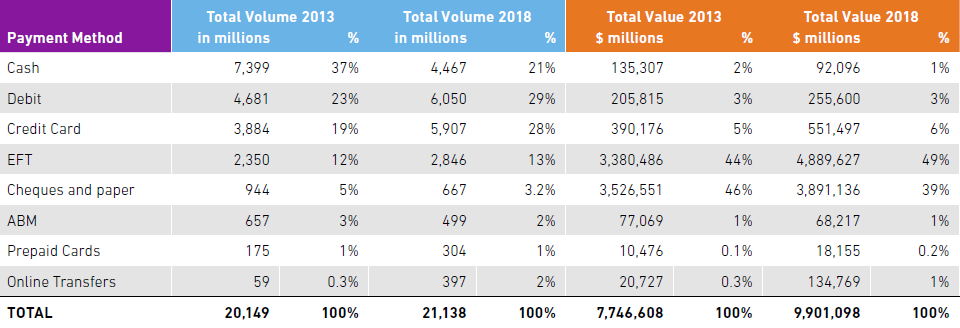

The newly released 2019 report analysed the 21.1 billion payment transactions made in 2018, totalling more than CA$9.9 trillion in value. The study points to insights and trends that continue to transform the payments landscape.

Key findings include:

- Overall average transaction size grew to CA$468 in 2018, up 22 per cent over five years from 2013.

- Electronic payments accounted for 73 per cent of total payments volume (number of overall payment transactions), and 59 per cent of total payments value (the combined monetary value of total transactions).

- Cash payments declined 40 per cent in volume over the last five years.

- Contactless payments grew 30 per cent year-over-year from 2017-2018 with a total of 4.1 billion contactless payments (card and mobile) worth CA$129.9 billion at the point-of-sale (POS). Debit represents almost 60 per cent of volume of these contactless payments - often viewed as a convenient substitute for cash. In fact, debit card use overtook cash for the first time in recent years.

- Mobile devices were used by nearly 35 per cent of Canadians for contactless payments on a regular basis in 2018, representing a slower uptake than contactless cards. Concerns about security remain the key barrier of usage, with less than a third of consumers expressing their belief that mobile payments are safe and secure.

- Explosive growth of online transfers, with a 52 per cent year-over-year increase in volume growth from 2017-2018.

- Debit and credit cards continue to make up the largest portion of total transaction volume, while electronic funds transfers (EFT) and cheque and paper transactions dominate the transaction value. A record three billion EFT transactions demonstrates the confidence businesses have in digital -- and the awareness of the value modern payments can bring for business improvements.

- Credit card use accelerated dramatically with a 52 per cent increase in transaction volume over the last five years from 2013-2018. Canada currently ranks second with highest volume use of credit cards per capita in the world after South Korea.

- Credit cards are now on par with debit cards as share of overall payments volumes, at 29 per cent and 28 per cent respectively in 2018. According to the research, continued growth in Canada’s exceptional credit card use is fuelled by two core factors: credit card rewards and the expansion of e-commerce in Canada.

- Cheque and paper volume represent only three per cent of total payment volume in 2018, a 29 per cent decrease over the last five years; however, they represent 39 per cent of total transaction value. 2018 also marked the near completion of migrating from paper cheques to the use of electronic cheques, with 70 per cent of cheques exchanged electronically as images.

“We are at a pivotal moment, with a number of key driving forces that are accelerating the transformation of Canada’s payment environment,” said Cyrielle Chiron, Payments Canada’s Head of Research and Strategic Foresight. “Evolving technology and industry innovation are changing the game, fuelled by consumer and business demands for friction-free, fast and secure payments.”

“There has been a remarkable transition from paper-based to digital payments over the last five years, but there is still a huge opportunity and need to advance Canada’s payments landscape,” Chiron said. “Looking to the future, our Modernization program is laying the groundwork to ensure Canadian consumer and business needs for more control, convenience and affordable payments, are met.”

Summary of all payment totals by volume and value of transactions

The Canadian Payment Methods and Trends report was compiled by Payments Canada with the help of payment service providers, payments consultants and researchers to help build a comprehensive understanding of the Canadian payments landscape in 2018.

About Payments Canada

Payments Canada ensures that financial transactions in Canada are carried out safely and securely each day. The organization underpins the Canadian financial system and economy by owning and operating Canada’s payment clearing and settlement infrastructure, including associated systems, bylaws, rules and standards. The value of payments cleared and settled by Payments Canada in 2019 was over $55 trillion or $218 billion each business day. These encompass a wide range of payments made by Canadians and businesses involving inter-bank transactions, including those made with debit cards, pre-authorized debits, direct deposits, bill payments, wire payments and cheques. Payments Canada is a proud supporter of the Catalyst Accord and the 30% Club.

For media inquires, please visit the Media Centre.