Canadian businesses and consumers more aware of payment fraud – but must remain cautious about mitigating risks

New research shows that since the onset of the COVID-19 pandemic, Canadian businesses and consumers appear to have become more aware and better equipped in protecting themselves against the risk of payment fraud.

Overall, 21 per cent of Canadian businesses and 12 per cent of consumers report experiencing payment fraud. While the rate of payment fraud experienced has remained stable for businesses and increased slightly for consumers, the risks remain top-of-mind with around half of businesses (53 per cent) and consumers (50 per cent) reporting that concern for fraud and cyber crime impacts their payment preferences and behaviour.

Even though Canadians are conscious about risks, 64 per cent of businesses and 67 per cent of consumers feel well-protected by their financial institution or credit card provider when it comes to making payments. Of those that did experience payment fraud, 57 per cent of businesses and 70 per cent of consumers report being satisfied with the resolution outcome by their provider.

It is imperative that Canadians remain vigilant. While the rate of fraud experienced remained relatively stable in 2021, it does not necessarily mean the rate of attempted fraud declined. Increased caution and diligence around payments will continue to be critical to help mitigate risks.

In brief

Business fraud insights

Around one in five Canadian businesses report experiencing payment fraud

Canadian businesses that have experienced any type of payment fraud are in the minority (at 21 per cent). Of the businesses that experienced fraud, the two most common types were ‘someone contacting the business pretending to be someone else and requesting money’ (29 per cent), and ‘credit card payment fraud’ - either concerning an unauthorized purchase made on their credit card (18 per cent) or seeing a transaction on their credit card statement that they did not make (17 per cent).

Profile of businesses experiencing payment fraud

Half of businesses state that fraud and cyber crime concerns impact payment preferences and behaviour

Around half of businesses (51 per cent) say that fraud and cyber crime concerns impact their payment preferences and behaviour. A further 50 per cent report that their employees make the effort to check the safety of an e-commerce site and go with trusted sites only when buying online.

Businesses feel better equipped to protect themselves against payment fraud since the pandemic

Overall, Canadian businesses express that they are more aware of and know how to protect themselves from payment fraud scams since the start of the COVID-19 crisis.

Reported financial loss related to payment fraud differs between B2B and B2C fraud

Of those businesses that experienced fraud in their dealings with other businesses (B2B), the large majority (74 per cent) report a loss of $500 or less in their fraud experiences involving money loss. Conversely, businesses that experienced consumer related fraud (B2C) incurred greater financial loss, with 55 per cent reporting a loss greater than $500.

Businesses feel well-protected by their financial institution or credit card provider

When it comes to making payments, 64 per cent of businesses feel protected by their financial institution or credit card provider, and believe they have recourse if they experience payment fraud.

Businesses report a high level of satisfaction in how payment fraud cases are resolved

More than half of businesses (57 per cent) that experienced payment fraud involving money loss report feeling satisfied with the resolution outcome. Likely, because it takes most businesses less than one week to resolve the issue (68 per cent), and they are usually fully reimbursed by their financial institution or credit card provider (60 per cent).

Electronic payments perceived as more secure than paper and card payments

Overall, businesses perceive electronic payments to be more secure than paper and card payment methods. Around half of businesses perceive both e-commerce (48 per cent) and mobile payments (45 per cent) to be secure for their purchases. Similarly, close to half of all businesses perceive mobile (48 per cent), in-app (46 per cent), and e-commerce (47 per cent) payments to all be secure ways to receive customer payments.

Businesses report that employees are mindful of fraud, but there is still room to improve

The majority of businesses indicate their employees are aware of and practice fraud and cyber crime prevention measures, but there are some areas for improvement. More than half of businesses (56 per cent) indicate that their employees usually limit the amount of sensitive information about the business they share online and only provide it when required. However, almost one in three businesses (30 per cent) say employees store passwords on their smartphone, computer/laptop, or in an email. A further 30 per cent say employees tend to use the same password for all of their accounts.

Consumer payment fraud insights

Only a small minority of Canadians experienced payment fraud

When it comes to consumer payment fraud, overall, only 12 per cent of consumers reported experiencing any type of payment fraud over the last six months. Of those that did experience payment fraud, ‘someone pretending to be someone else or a business’ (40 per cent) and ‘credit card payment fraud’ (39 per cent) were the two most common types of fraud. For cases involving money loss, the majority ( 45 per cent) lost $500 or less.

Consumers more confident in protecting themselves against payment fraud

Similar to businesses, consumers generally feel they are more aware and know how to protect themselves from payment fraud scams since the start of the COVID-19 crisis. This is likely due to the fact that more than one in four Canadians (27 per cent) reported experiencing payment fraud in 2020.

Attitudes towards payment fraud since the start of the COVID-19 pandemic

Concern for fraud impacts consumers’ payment behaviour and preferences

As with businesses, consumers indicate their concern for fraud and cyber crime impacts their payments behaviour and preferences. For example, two in three Canadians make the effort to check the safety of an e-commerce site and go with trusted sites only when buying online. When buying or selling items online on peer-to-peer marketplace sites (for example: Kijiji, Craig’s List), 33 per cent of Canadians use secure payment services like Interac e-Transfer or PayPal.

Consumers feel protected against the impact of fraud

Even though they are conscious about fraud and cyber crime risks, two out of three Canadians feel protected by their financial institution or credit card provider when it comes to making payments, and feel they have recourse if they experience fraud.

High level of resolution satisfaction

Of the 12 per cent of consumers who reported experiencing payment fraud, the significant majority (70 per cent) who reported related financial loss to their financial institution or credit card provider were satisfied with the problem resolution outcome. This is likely because it takes most Canadians less than one week to resolve the issue (58 per cent), and they are usually fully reimbursed (84 per cent).

Cash and electronic deposits perceived as most secure payment methods

Cash and electronic direct deposit to a bank account (EFT) are perceived to be the most secure payment method by Canadians. Young Canadians are more likely to perceive mobile and in-app payments to be secure compared to other age groups.

In conclusion

Supporting safe and secure payments remains a key priority in payments innovation. Insights from this study infer that the more awareness and understanding that Canadians have around the risks of payment fraud and scams, the more protected they are. From managing sensitive personal or financial information, being mindful of communication from potential impersonators, remaining diligent about unauthorized payments, to best practices in the secure use of technology, staying informed and alert is key to mitigate risks for Canadian businesses and consumers.

Contact us for a complete version of the research report.

About the research

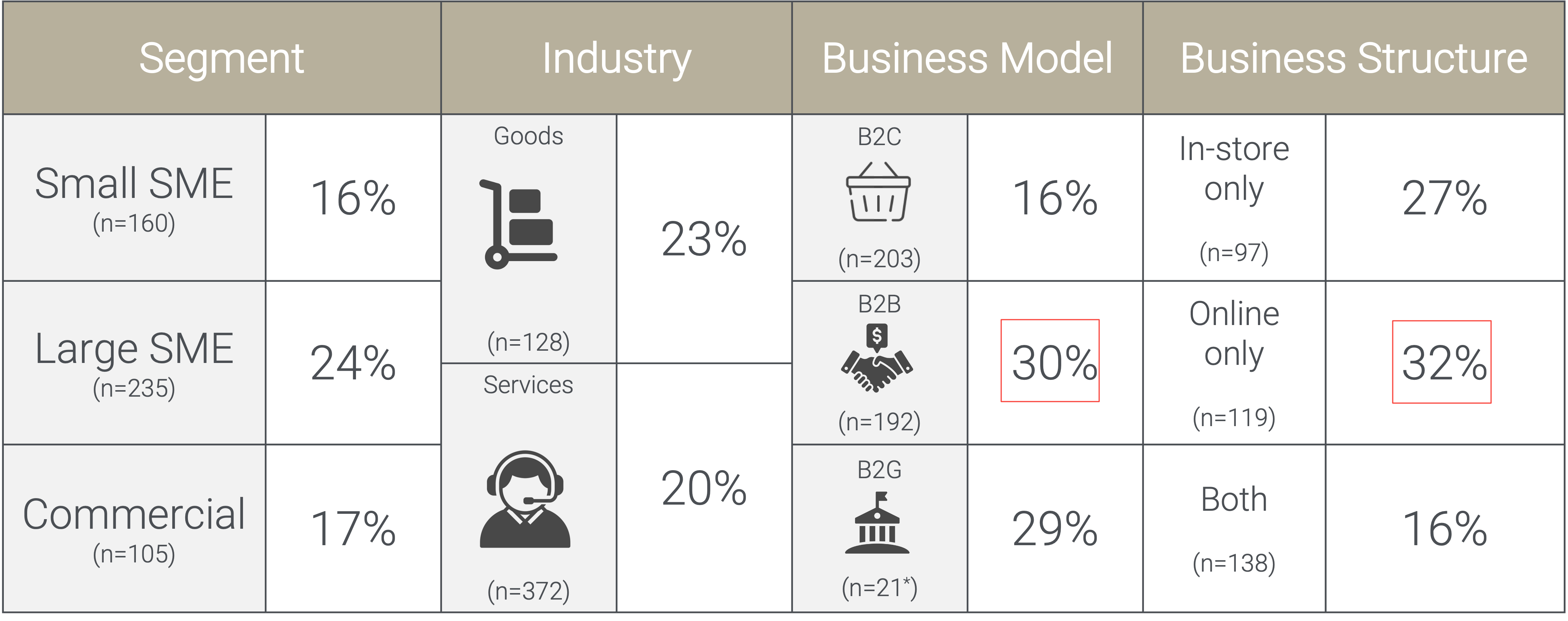

The findings in this report are sourced from the Leger/Payments Canada 2021 Consumer and Business Payments Behaviour Tracker Surveys (Wave 2). Note: some information contained in this report is sourced from additional waves of the survey tracker. In total, 500 Canadian businesses were interviewed online (395 SMEs and 105 COMs), between July 23 – August 6, 2021, using Leger’s online panel. Separately, 1,500 Canadians were interviewed online, between June 25 – July 9, 2021, using Leger’s online panel. The margin of error for these studies was +/-2.5%, 19 times out of 20. The sample is nationally representative of the Canadian adult population.