AI Solutions for Digital ID Verification: An overview of machine learning (ML) technologies used in Digital ID verification systems

DISCLAIMER: Articles are written to reflect the interests and views of the author(s), and are not intended as an official Payments Canada statement or position.

Summary1

In an increasingly digital world where concerns around fraud and misuse of personal data are growing, there is a call for more efficient methods of identity verification that go beyond the use of traditional Identity Documents (IDs) such as driver’s licenses and passports. Digital ID is an alternative to traditional IDs that verify identity using a combination of existing IDs and personal information attributed to an individual. However, Digital ID verification systems have shown enhanced accuracy and precision with the incorporation of artificial intelligence (AI) machine learning (ML) technologies.

This paper provides an overview of how Digital ID verification systems work with AI/ML technologies through ID document and biometric verification processes and what a cohesive Digital ID framework can do for the payments industry.

Digital Identity Verification

The COVID-19 pandemic has shifted the world “online”. Many workplaces have switched to remote work (some permanently), more consumers are engaging in e-commerce, and public service delivery is conducted online or via phone. With this massive shift online, security and identity verification becomes a key concern. Digital ID is an identity authentication solution that can help people gain control over their identities, help reduce fraud associated with identity theft and can ease KYC (know-your-customer) processes across industries. Traditionally, Identity Documents (IDs) have been verified manually but the expansion of industries to digital environments has demonstrated the need for scalable ID verification solutions that can handle expanding consumer needs such as Digital IDs.

Digital ID verification processes allow a person to verify their identity for a number of use cases, such as paying for a purchase or logging into a secure work environment when either the person and their physical ID are not present. Digital ID verification relies on methods like biometric and face recognition, where the "ID" being evaluated is a digital image and users present themselves concurrently via a digital image capture - either a photo or a video.

As entire countries and institutions work to implement Digital ID frameworks and processes, there is a need for quick, scalable and most importantly, accurate methods for ID verification. To support this, we are increasingly seeing the incorporation of artificial intelligence (AI) and machine learning (ML) processes in Digital ID products.

What are AI and ML?

Artificial intelligence (AI) is the capability of a computer system to mimic human cognitive functions such as learning and problem-solving. Through AI, a computer system uses a combination of math and logic to simulate the reasoning that people use to learn from new information and make decisions.

Machine learning (ML) is an application of AI. It’s the process of using mathematical models of data to help a computer learn without requiring direct instructions. This enables a computer system to continue learning and improving on its own, based on experience and memory.

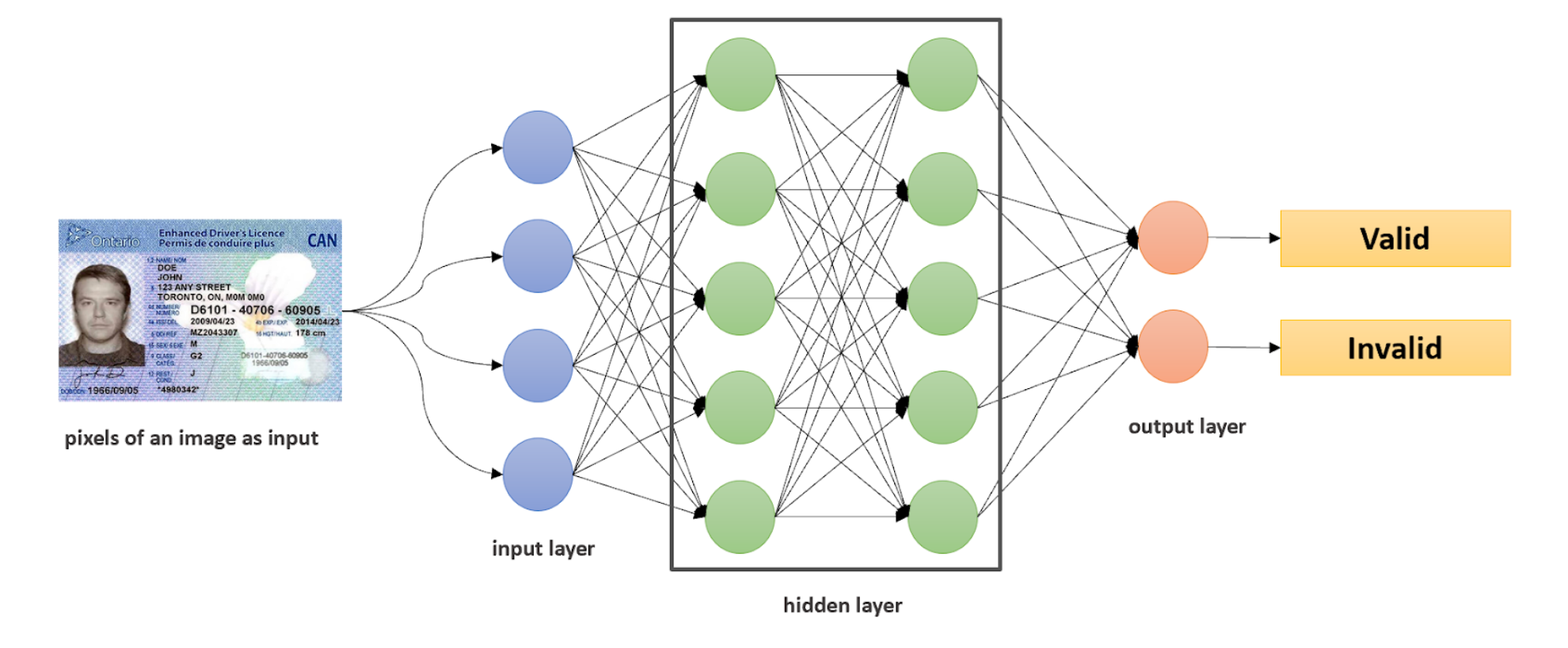

Machine learning models such as convolutional neural networks (CNNs) are used for many tasks such as image and video recognition, image analysis and classification, etc. (Figure 1). They come in very handy for object recognition and facial recognition and are often used by researchers as state-of-the-art technology for digital ID verification.

CNNs are mostly used for working with image data. They consist of three layers. The first layer (input layer) takes in the image that's to be classified. The next layer (hidden layers) works to extract key identifying features from the image for classification. The final layer (output layer) determines whether the image that's being classified is a match and ultimately verifies the ID2.

Figure 1: CNN used for image classification (Payments Canada)

Why AI for digital identity verification?

Close to six in 10 (57 percent) Canadians have seen fraud attempts increase this year3. The trend is likely to continue and become more and more implemented in all spheres of life. Technology giants like Google and Facebook have amassed a tremendous amount of their users’ personal data and expose their users to the risk of identity theft4 (Khan, 2018). The Digital ID program, soon to be implemented by Ontario’s government (Davidson, 2021), also leaves citizens vulnerable to cyberattacks concerning identity theft. The impact of COVID-19 on fraud in Canada is also huge, with $144 million CAD lost due to fraudulent activities as of August 2021 (Canadian Anti-Fraud Centre, 2021).

The question of how effectively and efficiently the identity of a person is verified so that they can perform digital tasks in a safe manner is one of the fundamental issues of our times.

Verifying IDs efficiently and at a high volume is difficult. Manual inspection of IDs alone, while relatively accurate if performed by experts, does not scale well for high volumes of cases. Fortunately, AI and ML technologies are maturing. With the incorporation of these tools, one can verify identity online for a multitude of use cases: businesses can confidently onboard employees, anywhere in the world with an ID and an internet connection; age can be verified for purchases like alcohol; governments will be able to disburse funds to end-users; etc.

There are several advantages of using an AI-managed system (Matthers, 2019):

- Determining the true identity of individuals becomes easier and faster.

- A facial recognition-based identity verification system is hard to circumvent.

- ML algorithms detect sophisticated forgery attempts more accurately than human intervention.

- Such systems can scale well to a large number of verification requests.

Banks and financial institutions are actively exploring AI and ML-powered identity verification solutions to detect fraud and prevent money laundering (Insights Team, 2018).

How does a Digital ID Verification system work?

There are many different methods of Digital ID verification that an AI-powered verification system can possess, which all work in different ways. The most basic and essential of these methods are:

- ID document verification: Checks that the digital photo of the ID (e.g. driver’s license, passport, government ID) provided by the user is legitimate.

- Biometric verification: Uses a user-provided facial image or a video to establish that the person presenting the ID is the same individual whose portrait appears on the ID. Users are asked to complete some tasks for additional security measures while being “live” on a webcam.

ID document verification

When a user provides a legal ID, it is typically government-issued, such as a driver’s license or passport. Each ID has a unique format and presentation of data. They also include security features such as watermarks, checksums, holograms, machine-readable codes (MZR) etc. Each of these factors is important when verifying an ID as proof of legal identity.

An ID document verification system aims to determine if an input image belongs to an authentic class of ID documents and if the document is legitimate. Several challenges should be addressed to accept the document as authentic.

- Document localization: the system isolates the identity document from the picture taken by the user in an uncontrolled environment such as variable backgrounds, angles, and camera qualities

- Document classification: the system classifies the type of ID submitted by the user

- Document verification: the system detects any perceptible document forgery

Document localization

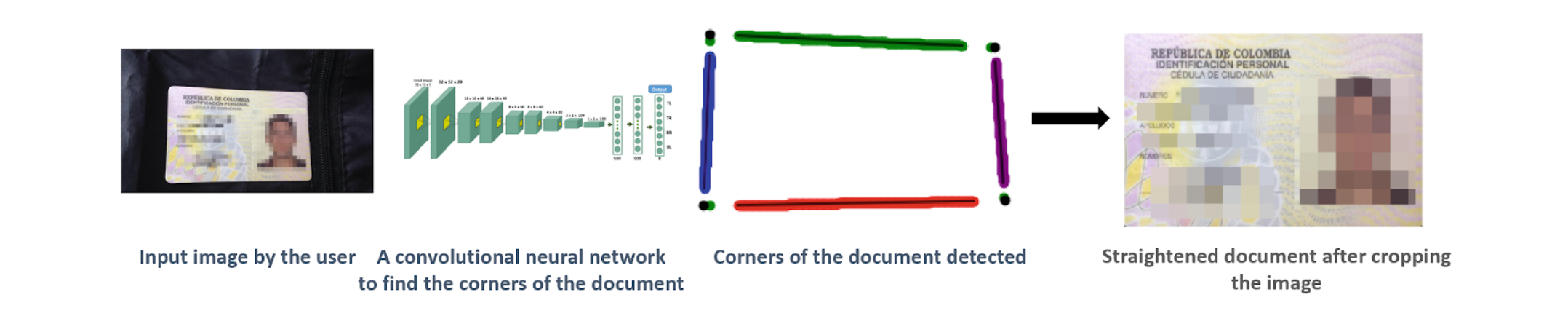

Document localization involves extracting documents from a given image and processing it. This ensures a standard input to the ID verification system. It is achieved through a region-based object detection model which detects an object in an image along with its coordinates. Using this information, the image is cropped and transformed into a correct orientation. The cropping and transformation ensure a standardized image with the ID being well focused and oriented in the center.

One such system uses Convolutional Neural Networks (CNNs) to identify the four corners of an ID document in a digital image (Javed & Shafait, 2017). Figure 2 depicts the sequence involved in the process.

Figure 2: Document localization using CNNs (Castelblanco et al., 2020)

Document classification

Given a digital image of an ID document, the purpose of a document classification system is to identify the class of the document. This involves identifying the country of issue, the type of document and its version. The types of documents include national identity cards, passports, driver’s licenses etc. One of the state-of-the-art systems used for document classification uses pre-trained CNNs. The CNN extracts key features from the image, which are parts and patterns present in the ID image that can help identify it (Simon et al., 2015).

Document verification

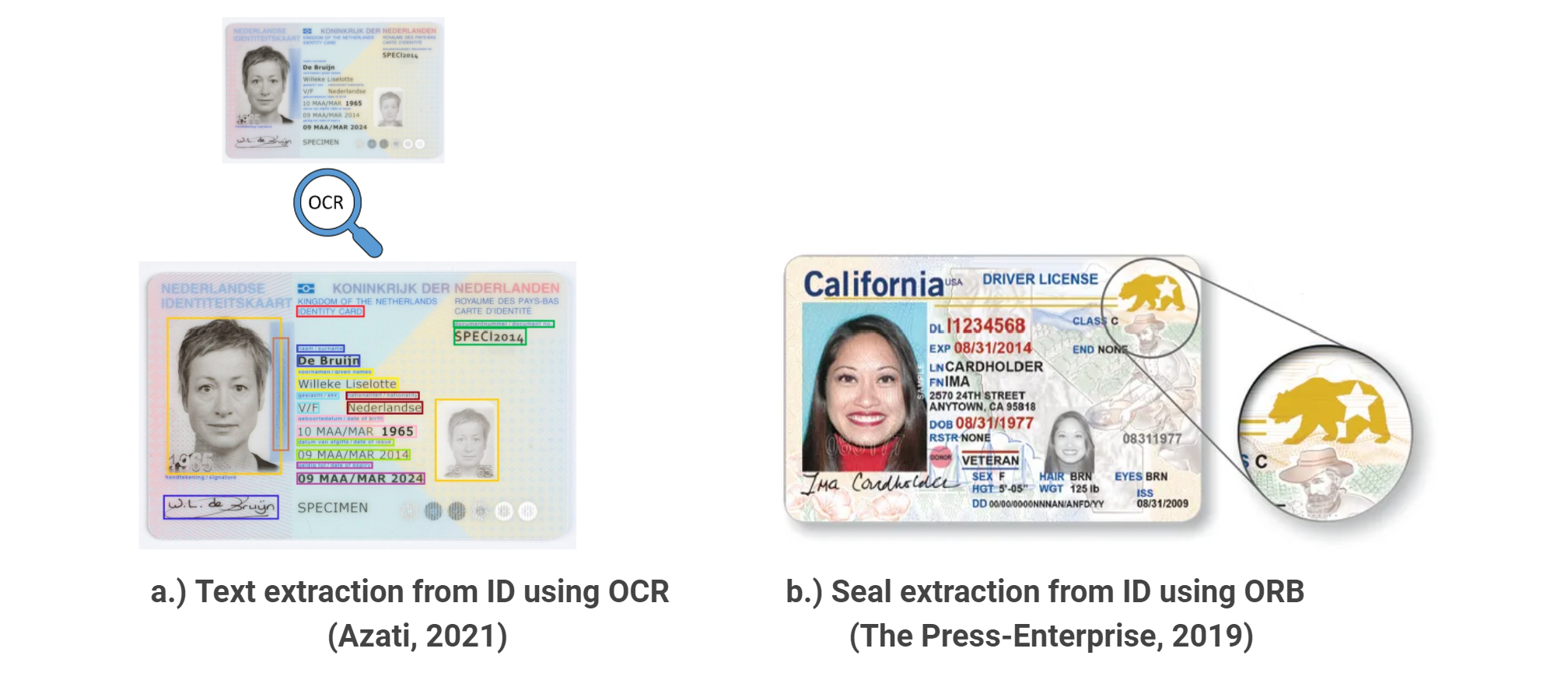

An ID issued by the government has information like customer images, seals, holograms, text stamps etc. Validating all security features in a scanned document is important because sometimes a small part of the document might have been forged and all other parts might show genuineness. For example, in any ID the hologram and seal are genuine, but the image present in the document is forged, or the image, seal, and hologram are genuine, but the signature is forged etc.

A document verification system verifies the above-mentioned security features. A system developed by (Sirajudeen & Anitha, 2020) again uses CNNs along with Optical Character Recognition (OCR) and Oriented fast and Rotated Brief (ORB) algorithms to retrieve and analyze the textual (name, signature etc.) authenticity and image (seal, stamp, hologram) authenticity of an ID as shown in Figure 3.a and 3.b.

Figure 3: Use of OCR and ORB for document verification

The results of text extraction (OCR) and image extraction (ORB) are fed into a CNN to verify the authenticity of the digital ID. The output layer of the CNN classifies the input values with probabilistic values between 0 and 1. If the resultant value is 1, then the scanned document is understood to be forged. If the probabilistic value of all the elements in the document (text, seal, stamp and hologram) is 0, then the document is classified as a genuine document.

Biometric Verification

After confirming that the digital copy of the ID is authentic, the system needs to confirm that the remote user presenting the ID is its authorized owner. The proof of ownership can be established by conducting biometric verification, including facial verification and liveness detection.

Fraudulent users may attempt to spoof the system with a printout of the target’s face or sophisticated 3D masks. AI and ML-based biometric verification systems can again protect against these attacks.

Facial Verification

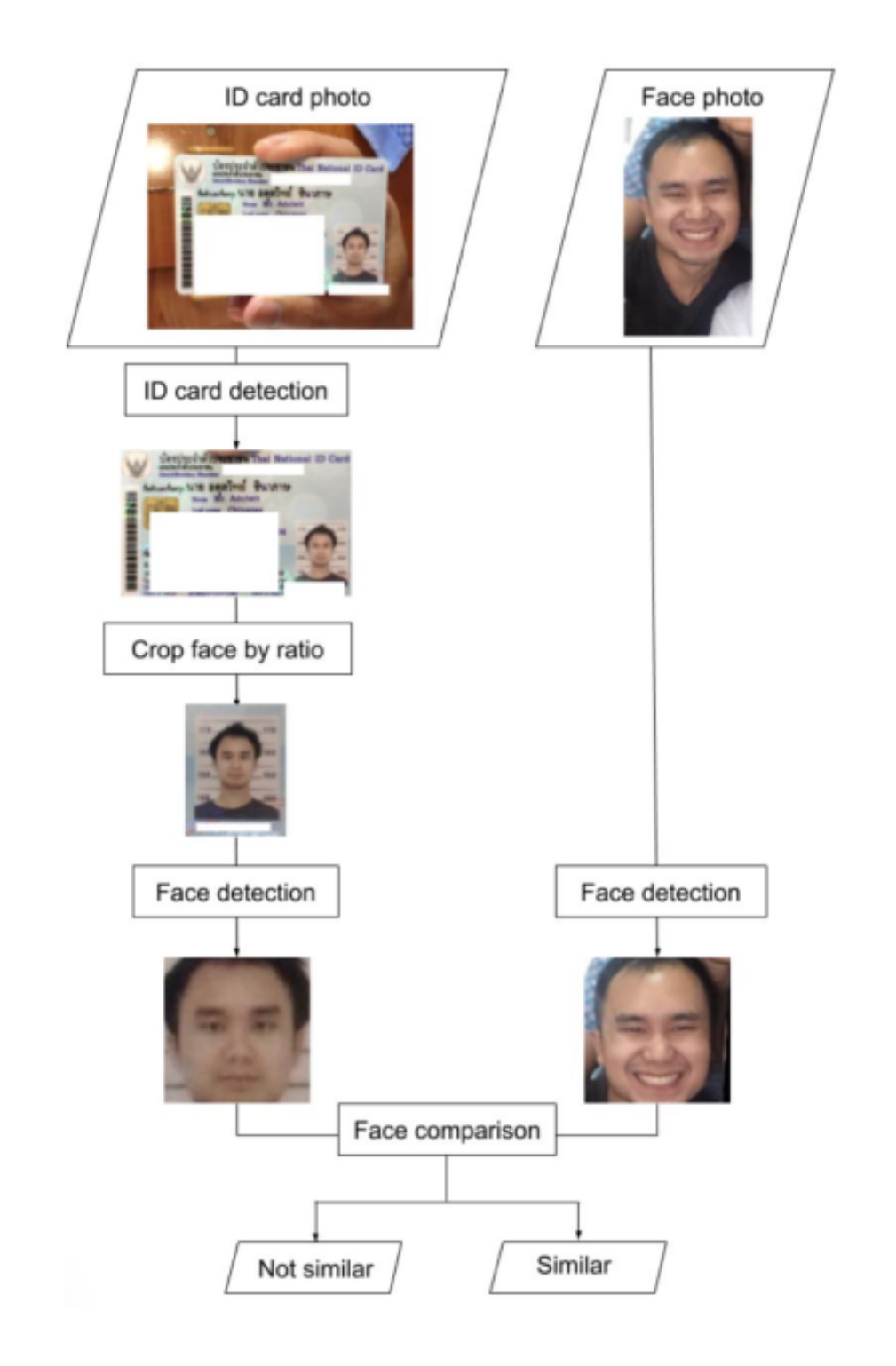

A facial verification system compares the facial image provided by the user against the facial image present in the ID (Figure 4). This helps in confirming that the user presenting is authorized to use the ID. The system may match features like skin texture, colour and a host of other features.

Chinapas et al., 2019 have developed a system that automatically compares a face on an ID card photo and a face photo to accelerate and increase the accuracy of the ID card verification procedure. They have used the MTCNN algorithm for face detection and ArcFace algorithm for face comparison.

MTCNN, as described in (Zhang et al., 2016), is a framework developed as a solution for face detection. It consists of three stages of CNNs that can recognize faces and landmark locations such as eyes, nose and mouth.

The network uses a cascade structure with three networks: first, the image is rescaled to a range of different sizes, then the first network proposes the user’s facial regions, the second network filters the bounding box (the region that contains the user’s facial image) and the third network proposes the facial landmarks5.

ArcFace (Deng et al., 2019) is an ML model that takes two face images as input and outputs the quantitative difference between them to see if they are likely to be the same person. If the difference is less than a threshold value then it considers the two faces to be a match. On the other hand, if the difference is greater than the threshold then it means that the two faces are not of the same person6.

Figure 4: Pipeline for a face verification system (Chinapas et al., 2019)

Liveness Detection

Liveness Detection can be added as an additional layer of trust in a biometric verification system to ensure the same user’s presence as he claims to be. Simple facial gestures like a smile, movement of the head etc., can help detect spoofing attacks like a video of a video, face mask or photo of a photo (Figure 5).

The most common form of liveness detection instructs the user to carry out a series of challenges in real-time like “say the number 429 and turn your head to the right”. The video will be analyzed in near-real-time with the ID image to check the liveness of the users and compare the face extracted from the video to the face on the ID.

Existing software-based techniques for liveness detection can be classified into four categories: (1) texture analysis based methods that can analyze the skin properties, including skin properties and texture reflectance (Li et al., 2004) (2) motion analysis based methods that investigate spontaneous motion cues in counterfeit presented in the recognition systems (Anjos & Marcel, 2011) (3) image quality analysis based methods that utilize image quality metrics to detect spoofing (Galbally et al., 2013) and (4) machine learning-based methods that are inspired by the recent success of CNNs (Li et al., 2016) and (Akbulut et al., 2017).

Figure 5: Face anti-spoofing database: 1st row live, 2nd row wrapped photo attack, 3rd row cut photo attack, 4th row video attack. 1st column low quality, 2nd column normal quality, 3rd column high quality (Akbulut et al., 2017)

What can Digital ID do for payments?

The importance of identity authentication is crucial with the current market landscape, which includes increasing security risks, abuse of data and the transition to our “new normal” consisting of remote everything. As mentioned above, with more people staying at home, there has been a considerable increase in the demand for digital identification solutions across all industries. Business use cases have exploded with security remaining top of mind for companies trying to keep their data safe with the surge in remote workers and reliance on unsecured networks and VPNs. Digital ID established itself as a cheaper, safer and faster alternative to traditional identification authentication processes for companies. While Digital ID can be used to increase operational efficiency across sectors, it opens up a whole world of opportunities for payments.

Cheaper and Enhanced Security for Payments

The implementation of Digital ID can push security, know-your-client (KYC) and strong-customer-authentication (SCA) of payments to the future while reducing the amount lost to fraud. Through the COVID-19 pandemic and the strong shift to digital payments, fraudsters had more of an opportunity to capitalize on consumers using new or different payment methods. Canadians have lost approximately $144 million to fraud since 2020 (as of September 2021. Canadian Anti-Fraud Centre). Banks, in particular, are working towards modernizing their approaches for fraud and since costs for identity authentication and other anti-fraud measures are rising significantly (the True Cost of Financial Crime Compliance Study notes a 33 percent increase in the cost of compliance measures from 2019 to 2020), a standardized Digital ID solution seems like an optimal solution. Across the globe, the implementation of Digital ID frameworks has substantially driven down the costs of KYC and AML (anti-money-laundering) processes. In India, the Aadhar Digital ID framework has been proven to reduce the cost of KYC verification from $5 USD to $0.70 USD per customer while concurrently reducing the rate of error in authentication (Mahajan et al., 2019).

Enabling Ubiquitous Digital Payments

Accelerated by COVID-19, digital payments are now at the forefront of payments with digital payments now making up 79 percent of all payments in Canada (Yun, Paturi, 2021) and with more consumers becoming comfortable with digital payments, we can expect to see an evolution in payment offerings. Digital ID can work to enable a seamless payments experience as the Canadian payments market evolves to include innovations like open banking, embedded payments and real-time payments. Digital ID frameworks are often used hand in hand with real-time payments systems as ID verification can be done in, or near, real-time with a high degree of accuracy. This allows for ease of the process and further standardization of ID authentication in cases like open banking frameworks where third-party providers like fintechs and alternative payment service providers can leverage Digital IDs established by incumbent financial institutions. The incorporation of Digital ID can lower costs and entry barriers for third-party providers and contribute to a competitive and innovative payments landscape.

Conclusion

As businesses and service providers have moved online and the advent of COVID-19, which has called for workplaces to move online, security and authentication have become one of the major concerns. Hence, a digital ID verification system built on AI and ML-based technology will detect sophisticated forgery on ID documents and be scalable to increasing customer demands and increase the speed and efficiency of verification systems. Hence, building a strong defence against fraudulent online activities.

1 The views presented in this paper are those of the authors and do not necessarily reflect the views of Payments Canada.

2 For a more detailed explanation on how CNNs work, please look here.

3 Please see Interac News for more.

4 Risk deterrents such as offline capabilities for IDs are planned to reduce this vulnerability.

5 For more details, please see: Multi-task Cascaded Convolutional Networks (MTCNN) for Face Detection and Facial Landmark Alignment.

6 For more details, please see: ArcFace : A Machine Learning Model for Face Recognition.

Authors

Sania Hamid

Junior Data Scientist

As a data scientist in the Research team, Sania conducts research on application of Machine Learning and Artificial Intelligence in the financial markets. Prior to joining Payments Canada, she completed her Master’s degree in Computer Science at Carleton University, where she worked on her thesis on Passenger Assignment For Ridesharing Through Supervised Learning.

Pooja Paturi

Analyst, Market Insights

Working with the Research and Strategy teams, Pooja does research and gives strategic advice on new payment technologies and developments in the payments space with a focus on digital currencies. In school, Pooja studied political economy.